Digital Payments

Initiative 3: Digital Payments

The government will support the modernisation of the payment system. This system will ensure secure, accurate and real-time payments. This will reduce payment costs, improve efficiency and offer flexible payment channels, such as EFTs, mobile wallets and instant payments like PayShap.

This initiative will reduce costs for the government when making payments by providing all government departments and agencies with equal access to cost-effective and modern payment and beneficiary management processes.

For people like Thandi this means payments will be reliable, secure and accessible. Thandi’s mother, for example, could receive her old-age grant payments via a mobile wallet or bank account. This will reduce fraud and corruption within the government by ensuring that the right person gets paid the benefit.

Project 3.1: Instant, Effortless and Cost-Effective Payments for All

This project will expand payment options for the government, people and organisations. This is driven by the extensive work that has been undertaken by the SARB in the Payments Ecosystem Modernisation Programme.

This includes cost-effective, real-time payments using QR codes, phone numbers, vouchers and other means. This will make it easier and safer for people, especially those in underserved areas, to access payments and transact digitally. This project includes the establishment of a payments utility to bring down payments costs.

Project 3.1 – Phase 1 and Indicative Phase 2 Milestones

- Conduct a cost-benefit analysis on the feasibility of a domestic card payment scheme, with a focus on potential applications for social grant recipients (Q4 2026)

- Begin rolling out a digital financial identity solution (Q4 2026)

- Provide instance, cost-effective payments to a preferred store of value through the Rapid Payments Programme (Q4 2027)

- Establish a Public Payments Utility for transaction processing (Q4 2030)

Project 3.2.1: Improved Government Payments

Government departments and agencies use a variety of systems and payment providers to make payments to people and organisations. There is opportunity to reduce the costs by developing common payment systems and processes to leverage economies of scale, and to ensure the innovations developed in Project 3.1 are used effectively.

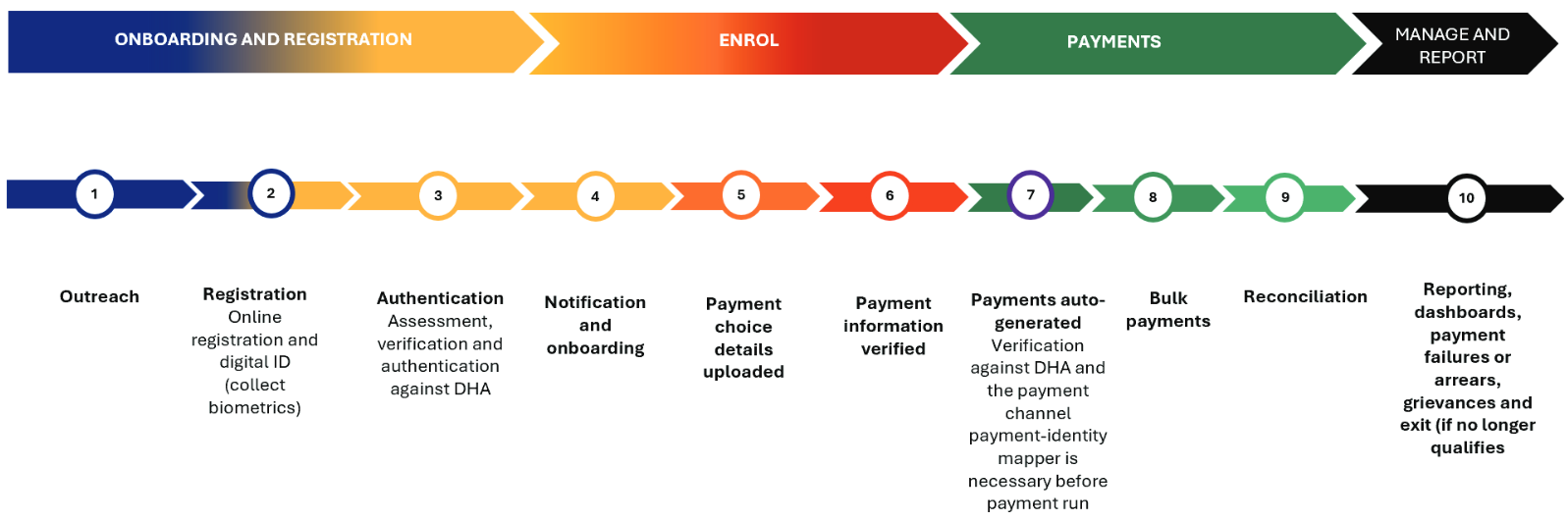

An E2E G2P system for agencies will be developed at SASSA by building on existing infrastructure through the addition of DPI components. This system can then be adopted by other agencies. The system will deliver on all functions through the service lifecycle, from registration to reporting, as highlighted in the value chain below.

The system will then be further enhanced to allow the government to accept payments from people, and to enable government and businesses to make and receive payments with each other.

Project 3.2.1 – Phase 1 and Indicative Phase 2 Milestones

- Develop E2E G2P system for Child Support and SRD370 Grants (Q4 2026)

- Develop the Payment Gateway for Government-to-Person payments in SASSA (Q4 2027)

- Deploy the E2E G2P system in one more government entity, leveraging the payment gateway (Q4 2027)

- Enable government-to-business (G2B) and business-to-government (B2G) payments in the E2E system (Q4 2028)

- Deploy the E2E system in two more government entities, leveraging the payment gateway (Q4 2030)

Project 3.2.2: IFMS Payments System

An E2E G2P system for departments will be developed by introducing equivalent features into IFMS. This will enable all government departments to onboard beneficiaries and manage payments across multiple channels, such as bank accounts, mobile wallets, or cards.

The IFMS development team will collaborate closely with the developments in the SASSA pilot to re-use technologies and create opportunities for interoperability.

Project 3.2.2 – Phase 1 Milestones

- Research the potential savings of a government payments switch (Q4 2027)

- Develop a G2P payment module in IFMS (Q4 2027)

- Develop a government payments switch conditional on the research results (TBD)